The Health Insurance Fund of Australia (HIF) remains one of Australia’s most competitively priced health insurance funds following the Federal Government’s premium increase announcement today.

The Health Insurance Fund of Australia (HIF) remains one of Australia’s most competitively priced health insurance funds following the Federal Government’s premium increase announcement today.

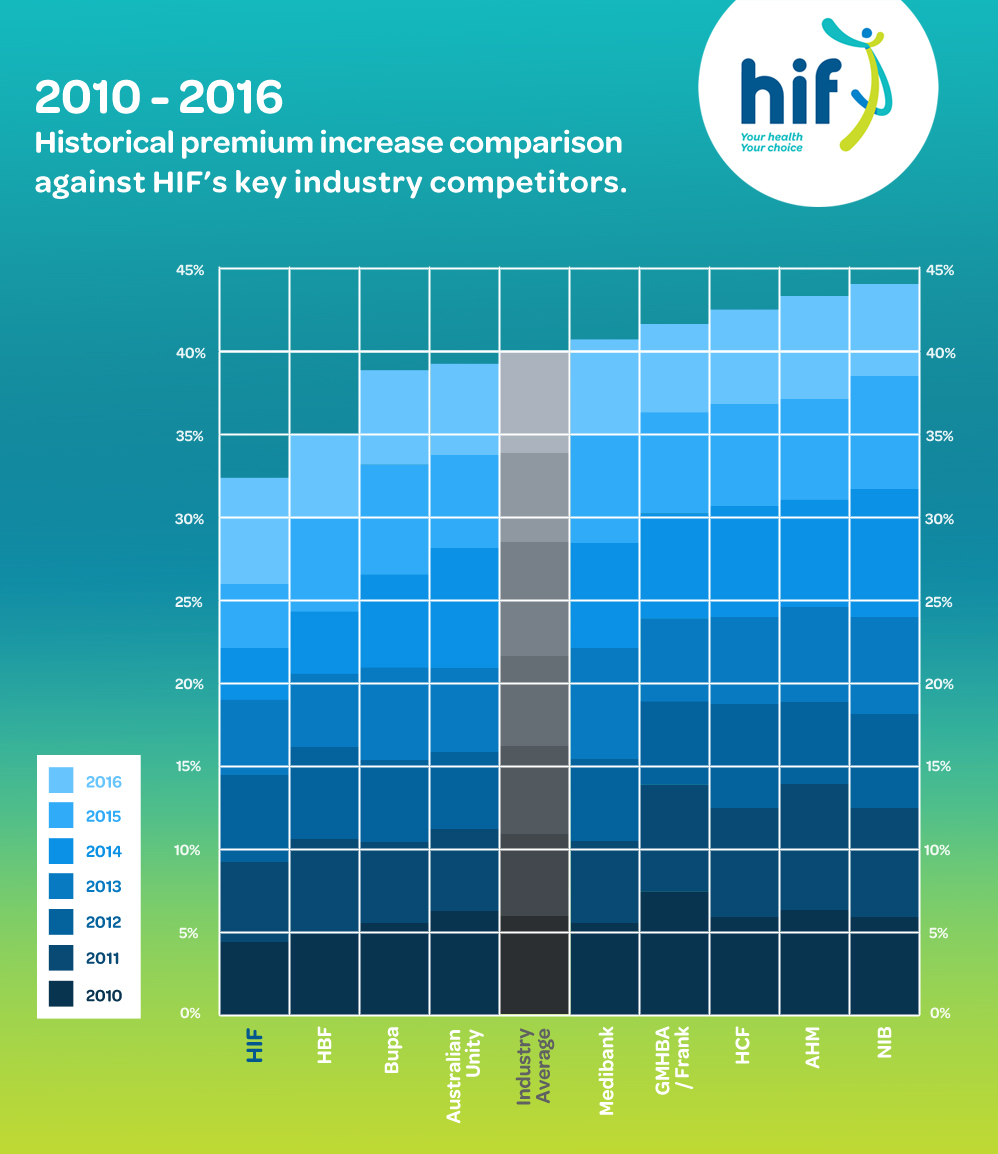

While HIF’s latest average annual increase of 6.55% was slightly higher than previous years (4.49% in 2015 and 2.98% in 2014 respectively), historical data shows that when compared to our main industry competitors, our average annual increase over the past seven years has been just 4.68% - the lowest of all key competitors.

In reference to Minister Ley’s announcement today, HIF managing director Graeme Gibson said,

“Each year we work hard to provide the best value policies for our members and keep price rises down to the minimum necessary. This year’s average increase of 6.5 percent was influenced by a number of factors including the rising cost of healthcare on the back of higher charges by providers, increasing member claims because of the general ageing population, increasing rates of chronic disease, and advances in medical technology.

HIF has kept its premium increases low year after year. In both 2014 and 2015, we had the lowest average premium increase of all Australian health funds open to the general public. So, although our percentage increase is a little higher than usual this time around, the years of keeping our increases low means our product prices are still very competitive, as the percentage increase will be coming off a lower base rate. To put this in context, dollar for dollar, HIF members are 6.1% better off compared to the six year average industry increase.

As Australia’s fastest growing not-for-profit health insurer, and second fastest growing overall, our key priority will always be our members. We don’t have shareholders to factor in, so HIF’s premiums will only ever be increased to a necessary level each year in order to improve our rebates and benefits, ensure our members’ claims are covered and accommodate rising healthcare costs.”

In a press release issued this morning by Private Healthcare Australia, PHA Chief Executive Dr Rachel David said,

“Funds take the issue of premium increases very seriously and the industry has repeatedly shown its willingness to keep premiums as low as possible. In addition, health funds are working with Government and other stakeholders to reform prostheses pricing regulations, on measures to remove red tape and make health fund products more transparent and easily understood by consumers.”

Dr David said the costs of healthcare in Australia were increasing across the board as a result of our ageing population, growth in chronic disease, advances in medical technology and higher charges by healthcare providers.

“While no one likes to see premiums go up, most people accept a reasonable increase as necessary to ensure they can continue to access the private healthcare system. Members understand that health funds must hold sufficient reserves to pay out on claims made by members, now and in the future. During 2014-15 there was a 7.2% increase in benefits paid out by health funds while the premium increase was 6.18%.”

For all media enquiries: Please call Donna Cole on 0419 901 229.

Want more info? Check out our quick FAQs.

Why do premiums go up each year?

Each year on April 1, the health insurance industry (all funds inclusive) raises premium rates on existing products. A number of factors lead to these increases, for example: rising health related expenses, increased doctor charges, medical equipment and technology, increases in claims frequency, and more.

Why are health costs rising more than the Consumer Price Index (CPI)?

The annual health insurance premium increase reflects the rising cost of healthcare overall. The Consumer Price Index only reflects price increases for a pre-defined range of goods including food and clothing, and is currently held down by the falling oil/petrol prices. As CPI does not reflect an increase in private healthcare usage, it simply can’t be compared to a health insurance premium increase.

Why is my premium increasing by more than the HIF average percentage?

The average percentage increase is an average across all policies, states and territories, but each product is priced individually depending on the increasing health care costs associated with that product in each state or territory. For that reason, some of our rates have gone up less than the average and some more – depending on the costs associated with the particular product or location. This year’s adjustment to the Federal Government Rebate will also result in a reduction of the discount you receive off the price of your policy by the Government. The erosion of the rebate is driven by the Government and is not a decision implemented by HIF. It’s also important to note that the rebate does not apply to any Lifetime Health Cover Loading (LHC), effective from 1/07/2013.

How will the premium increase affect me if I’ve paid my contributions in advance?

If you pay your premiums prior to 1 April, you will enjoy rate protection for that time, including other changes that may impact your premium after April 1 such as the reduction of the Federal Government Rebate. That means that you will pay your premiums at the current rate for the duration of that upfront payment, which can be 12 months worth of premiums, 6 months, 3 months, 1 month or one fortnight. If you do choose to make an upfront payment of 12 months, you will also receive an additional bonus discount of 4% (or 2% for six monthly payments).

Does HIF profit directly from premium increases?

No. Unlike some of our competitors, HIF is a member-owned, not-for-profit company. This means that the company has no shareholders to report or distribute profit to. Any net operating margin that is earned as a result of this rate rise will be directly added to the fund’s reserves to ensure the future payment of claims and reduce pressure on any future premium increases. The Board of HIF, whose role is to represent the best interests of members, would not be acting responsibility if rates were not increased at this time

I’m an HIF member. By how much will my standard contribution increase and when are the new rates effective from?

The exact details of how the premium increase will affect you personally will be communicated to you in writing prior to April 1.

I’m currently with another fund but I’d like to switch to HIF. What do I need to do?

Switching to HIF is easy as. Simply call us on 1300 13 40 60 or join online (it only takes a few minutes). During the online application process, we’ll ask for the name of your current fund, your previous member number and your authorisation to contact your previous fund on your behalf - then we do everything else! No forms to fill in, no paperwork, nothing. We’ll also honour your previous length of membership, meaning that you receive the highest benefits applicable to your new level of cover, and you don’t have to re-serve any unnecessary waiting periods.

How does HIF’s increase compare with other funds?

Please refer to the graph below for a seven year comparison against HIF’s major industry competitors.